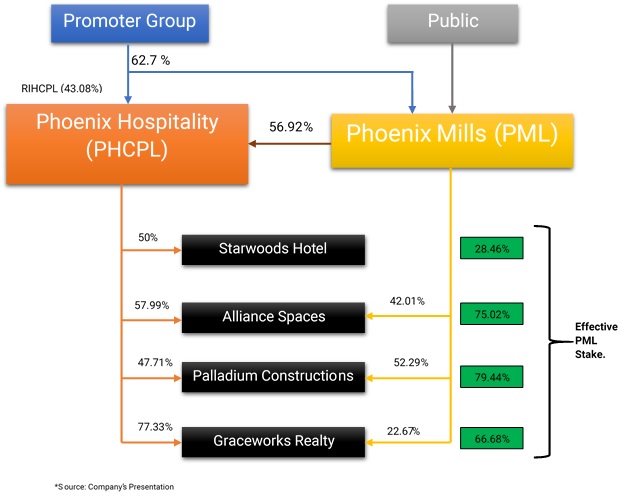

The Phoenix Mills Limited (PML), India’s largest retail-led mixed-use developer and operator has announced a scheme of amalgamation of its subsidiary company, Phoenix Hospitality Company Private Limited (PHCPL) with PML. Over a period, PML used PHCPL as a holding company for the number of its projects. Part of PHCPL is owned by the promoters of PML directly.

Phoenix Mills Limited is a leading retail mall developer and operator in India and is the pioneer of retail-led, mixed-use developments in India with completed development of over 17.5 million square feet spread across retail, hospitality, commercial, and residential asset classes. The company has an operational retail portfolio of approximately 6 million square feet of retail space spread across eight operational malls in six gateway cities of India. The company is further developing five malls with over 4.9 million sq. feet of retail space in five gateway cities of India. Besides retail, the company has an operating commercial office portfolio with a gross leasable area of 1.32 million sq. feet and plans to add approximately 4.0 million sq. feet of commercial office across existing retail properties going forward. The equity shares of the company are listed on nationwide bourses.

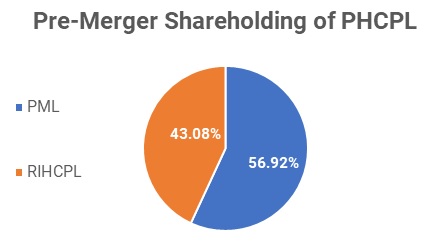

Phoenix Mills has announced merger of its subsidiary Phoenix Hospitality Company Pvt Ltd with itself and the merger was approved by the respective boards. PML holds a 56.92 per cent stake in PHCPL with 43.08 per cent being held by Ruia International Holding Co Pvt Ltd.

Ruia International Holding Co. Pvt. Ltd. (RIHCPL) is a promoter group entity and as of quarter ended June 30, 2019, held 32.18% stake in PML out of the total promoter holding of 62.75%.

Phoenix Hospitality Company is a holding company for certain SPVs involved in the business of real estate development.

PHCPL has ownership interests in the following SPVs:

- Starboard Hotels (Palladium Chennai – Operational Retail Mall: GLA of 0.22 MSF; plus underdevelopment commercial office space of 0.43 MSF) – PHCPL holds 50.00% equity stake and the balance 50.00% is held by a third party in the SPV.

- Alliance Spaces (Fountainhead – Commercial Development: Operating GLA of 0.16 MSF and under–construction GLA of 0.55 MSF) – PHCPL owns 57.99% equity stake and PML holds the balance 42.01% equity stake.

- Palladium Constructions (One Bangalore West and Kessaku – Residential Development: Total saleable area of approx. 3.19 MSF; Courtyard by Marriott Agra: a 193-key operational hotel) – PHCPL owns 47.71% equity stake and PML holds the balance 52.29% equity stake.

- Graceworks Realty & Leisure (Phoenix Paragon Plaza – Commercial Development: Operating GLA of 0.41 MSF) – PHCPL owns 77.33% equity stake and PML owns the balance 22.67% equity stake

The Transaction

From the appointed date April 1, 2019, Phoenix Mills Limited (PML) will merge one of its subsidiary company, Phoenix Hospitality Company Private Limited (PHCPL) subject to the requisite approvals. Pursuant to the terms of the Scheme, PML will allot 6.27 million shares to RIHCPL, i.e. RIHCPL will receive 627 (six hundred and twenty seven) fully paid-up equity shares of PML of face value of INR 2 each for every 100 (hundred) fully paid-up equity shares of face value of INR 10 each held by RIHCPL in PHCPL. Consequently, the promoter group holding in PML shall increase by 1.46% to 64.21% from 62.75%.